AMRIT KAAL OPPORTUNITIES FUND CAT III

Regn No. IN/AIF3/23-24/1435 Fund Manager : Mr. Sadanand Shetty

India a beneficiary of global power shifts,

says MSCI Research

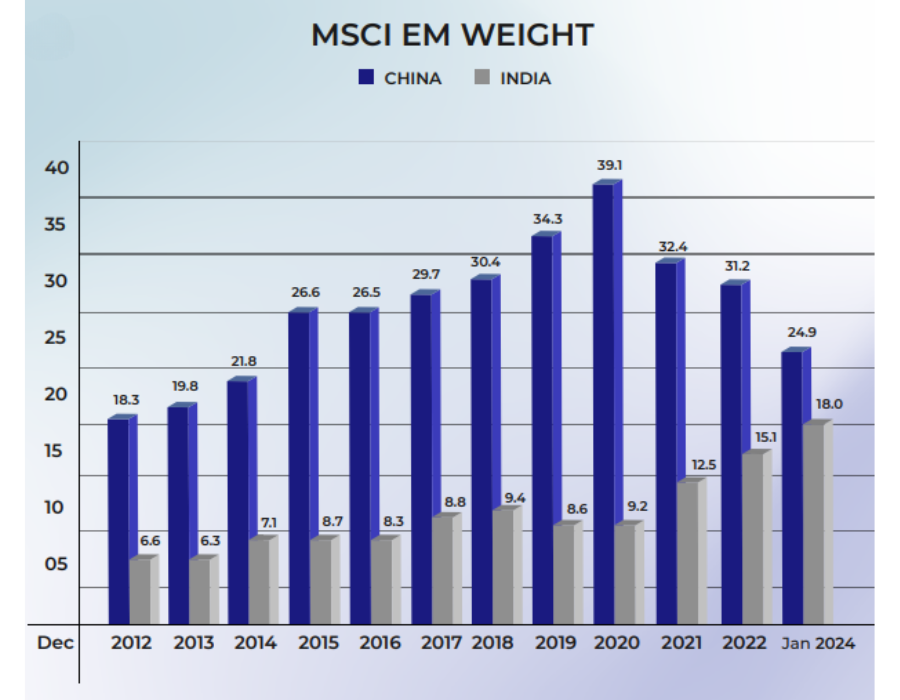

Global power shifts, with India being an undisputed beneficiary of the changing power dynamics, is expected to be one among the five major investment themes that are expected to play out in 2024, according to researchers at MSCI.

As of February 2024, India’s weightage in the MSCI Emerging Markets (EM) index is 18.2%, a record high. This is almost double India’s representation in the index from 2015 until October 2020, when it stood at around 8%. India’s weightage has also surpassed Taiwan’s.

India could surpass Germany and Japan

become the world’s third-largest economy by 2030

| USA | 6.0 |

| JAPAN | 3.2 |

| GERMANY | 1.6 |

| FRANCE | 1.3 |

| UK | 1.2 |

| ITALY | 1.2 |

| CANADA | 0.6 |

| IRAN | 0.6 |

| SPAIN | 0.5 |

| BRAZIL | 0.4 |

| USA | 10.3 |

| JAPAN | 5.0 |

| GERMANY | 1.9 |

| UK | 1.7 |

| FRANCE | 1.4 |

| CHINA | 1.2 |

| ITALY | 1.1 |

| CANADA | 0.7 |

| MEXICO | 0.7 |

| BRAZIL | 0.7 |

| USA | 14.9 |

| CHINA | 6.1 |

| JAPAN | 5.7 |

| GERMANY | 3.4 |

| FRANCE | 2.6 |

| UK | 2.4 |

| BRAZIL | 2.2 |

| ITALY | 2.1 |

| INDIA | 1.7 |

| RUSSIA | 1.6 |

| USA | 25.5 |

| CHINA | 18.1 |

| JAPAN | 4.2 |

| GERMANY | 4.1 |

| INDIA | 3.4 |

| UK | 3.1 |

| FRANCE | 2.8 |

| RUSSIA | 2.2 |

| CANADA | 2.1 |

| ITALY | 2.0 |

| USA | 32.4 |

| CHINA | 27.5 |

| INDIA | 5.6 |

| JAPAN | 5.3 |

| GERMANY | 5.0 |

| UK | 4.2 |

| FRANCE | 3.4 |

| BRAZIL | 2.8 |

| CANADA | 2.6 |

| ITALY | 2.5 |

Reforms Have Transformed India’s Outlook

STRUCTURAL REFORMS

- GST

- RERA

- PLI Scheme

- IBC

- Corporate tax cuts

- Aadhaar

- NIP-Infra spend

- Jal Jeevan Mission

- Affordable housing

FORMALIZATION

- UPI – Digital payment Infra

- FASTag

- Jan Dhan/Financial Inclusion

- Direct Benefit Transfer

- Low-Cast Data Availability

- Stricter Tax Compliance Rules

- ONDC

- Account Aggregator

MACROS

- Sharply Improving Tax Buoyancy

- High Forex Reserves

- Demographic Dividend

- Massive Urbanization Scope

- Strong FII Inflows

- Vibrant Start-up Ecosystem

- Shift of saving from Hard Assets to

- Financial Assets

- Manufacturing shift to India (China + 1)

- Inflation in Control, Interest Rates Favorable

India : All Set for the ‘Big Leap’

Demographic Dividend

By 2025

29 Years – Average age.

Rising Consumption

2017 – 2025

$ 1.3 Tn. to $ 3.6 Tn.

Digital India

2017 – 2025

450 Mn to 900 Mn Internet users.

Financial Inclusion

J.A.M Trinity

100% Aadhar linked bank A/c s.

Robust Infrastructure

2016 – 2023

$1.5 Tn – $2 Tn financing demand.

Urbanization

By 2025

100+ smart cities, 30 people move every minute to urban areas.

Upward Mobility

By 2025

150Mn to be added to middle class.

GST Impact

Expected Cost Reduction

12-14% in capital goods, 5% in retailer’s cost, 20% in logistics.

Startup Ecosystems

By 2025

1,00,000+ Startups, 90 Unicorns currently.